Tytanid’s Solana Quarterly Report - Q2 2022

This report provides an overview of Solana's architecture and network performance using on-chain data.

Abstract

Solana is a popular open source blockchain project that is maintained by the Solana Foundation. The main goals of this network are to continuously increase scalability as well as a transparent and user-friendly experience. No less important element of Solana's philosophy is to maintain a high level of decentralization by about 1.9 thousand nodes and to constantly strive to reduce transaction costs from any interactions with this blockchain.

In its foundations, Solana is based on an innovative hybrid consensus model, which is a mix of a unique algorithm called Proof of History (PoH) with the Proof of Stake (PoS) version. PoH is a specific type of proof to verify the order and time lapse between individual events, helping the network to achieve sub-second finality in less than a second. This is because it reduces the overhead of sending messages between nodes. The Solana network was designed so that it can in theory process approximately 710,000 transactions per second (TPS) without the need for any additional scaling solutions.

In this quarterly report, we focused on the performance of solutions developed by the Solana Foundation in the second quarter of 2022. We will also present the key changes implemented by the development team for this project to improve the overall network performance and positively enhance the user experience.

Key events: Q2

Solana launched an investment and grant fund worth around USD 100 million for web3 startups in South Korea.

- Solana Ventures, together with its strategic investment company Solana Labs, and the Solana Foundation announced on June 8, 2022 the creation of a dedicated investment and grant fund worth USD 100 million in South Korea.

- The aim of the investment conglomerate is to increase the pace of development and activity in the web3 sector. The investment strategy focuses primarily on areas such as DeFi, NFT and GameFi.

- South Korea dominates the world in the GameFi industry in terms of innovative mobile games, free games and e-sports, and has already created a dynamic and scalable web3 ecosystem at this stage. These achievements led to the fact that South Korea was chosen as the place where Solana's team established its investment conglomerate.

- In the coming quarter, developers specializing in web3 technology development can also take part in the annual Solana Hacker House event in Seoul, as well as in several other locations where interested parties can make new contacts as well as obtain valuable information about the Solana ecosystem.

Mainnet beta crashes

- The Solana network in the second quarter of 2022 experienced 2 significant interruptions in the operation of the mainnet network, which were caused by the blocking of the consensus mechanism. The first shutdown occurred on April 30, 2022, and the network itself resumed operation on May 1, 2022. On the other hand, the second failure occurred a little later, on June 1, 2022, and was resolved on the same day.

- From the beginning of the year, Solana suffered from minor but cyclical problems with network congestion, which resulted mainly from the activity of bots targeting NFT mints. The direct cause of the April failure was a huge amount of inbound transactions (6 m / s) that flooded the network, which exceeded 100 Gbps of traffic in individual nodes.

- Solana's network issues in June were due to a runtime error that allowed the failed transaction to be processed twice. This led to nondeterminism, a situation where the validator processed a transaction twice and some nodes rejected another block while others accepted it. Only about 33% of validators accepted the block, while 66% is required to reconcile the indeterminism.

Latest network updates

To keep pace with the demand for mass blockchain adoption, the developers of the Solana network tested and implemented several significant network updates.These are as follows:

- The team behind Solana's network tried to prevent abuse of their nodes by re-implementing Solana's transaction processing protocol to QUIC. This system architecture is designed and built by Google. QUIC was developed for high-speed asynchronous communication that fits well with Solana use case, but with sessions and flow control similar to a connection-oriented protocol.

- Solana, taking advantage of the fact that it is a PoS type network, expanded the usefulness of weighing rates to the quality of transaction service. In this model, a node with a 0.5% stake would have the right to forward at least 0.5% of the packets to the leader, and the rest of the network and any combination of the remaining shares would not be able to fully flush them out.

- A new instruction has been introduced into the Compute Budget system solution, which is one of the flagship products developed by the Solana team. This gives users the option to specify an arbitrary "additional fee" to be charged after the transaction is executed and placed in a block. The ratio of this charge to the requested units of compute would serve as the weighting of the execution priority of the transaction. In such a case, the additional fees would also be treated in the same way as the basic fee.

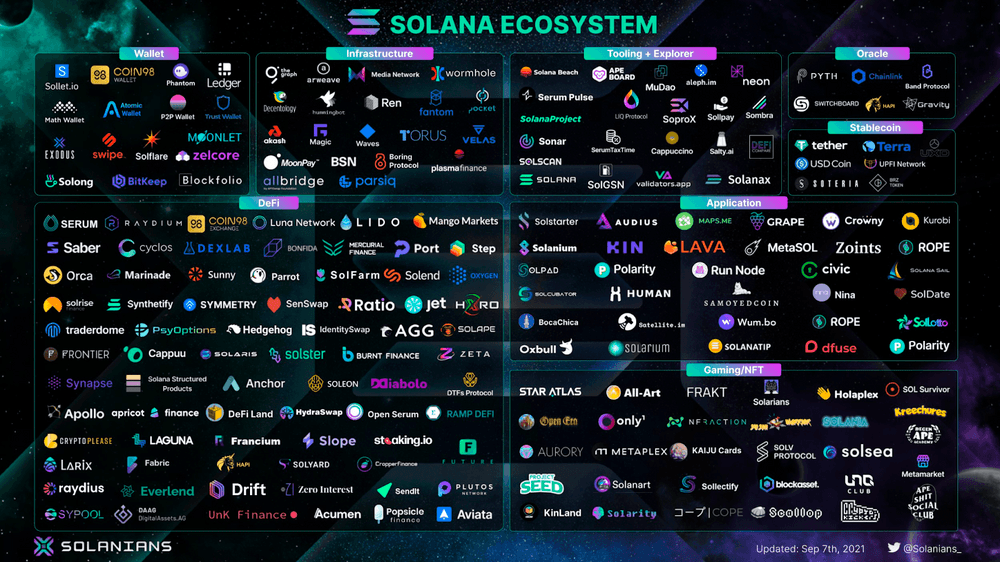

Solana Ecosystem

Source: Solanians

Solana is a system architecture that is not compatible with EVM, but despite this fact, Solana's ecosystem currently has over 400 projects, including DeFi, GmeFi, web3 and NFT applications. Fast transactions and low fees are constantly attracting a large number of new users primarily thanks to several notable projects being built on the Solana network, such as Serum, Mango Markets, Star Atlas, Magic Eden and StepN.

Neon alpha

An EVM compliant smart contract layer created by Neon Labs launched Neon Alpha on devnet in mid April 2022. The tested functionalities included limited dApps, the implementation of NeonPass, the launch of NeonScan, but also the implementation of MoraSwap. Over the next few quarters, Neon Beta will be launched in the mainnet, which will then allow Ethereum developers to integrate their applications on Solana.

Tytanid data

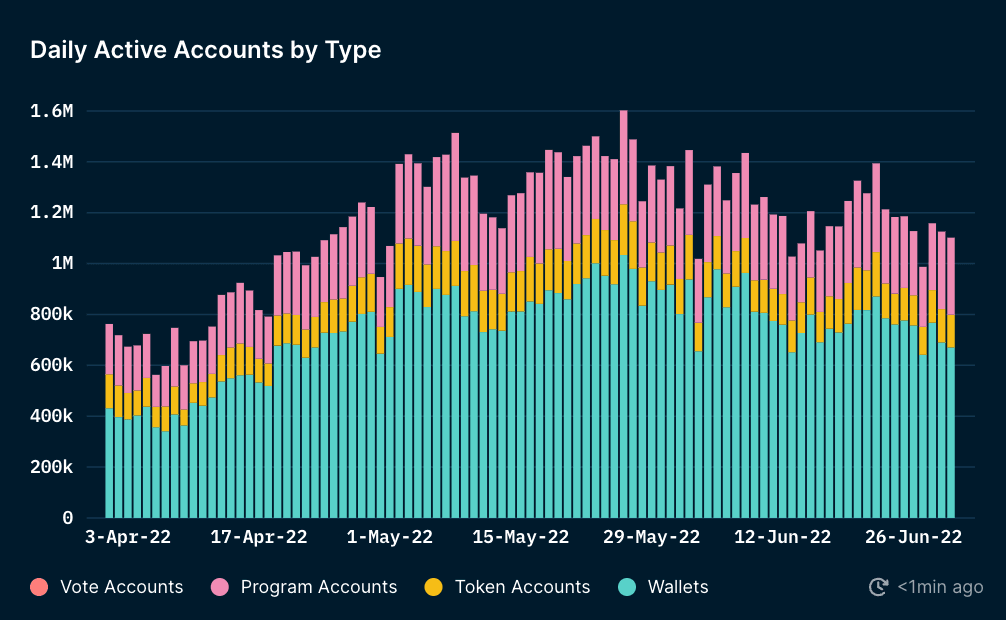

Daily Active Accounts

Source: Tytanid

The data in the chart above shows that the number of active accounts has increased since the beginning of the quarter, from around 400,000 portfolios to almost 1 million at the end of May. Since then, the number of active accounts per day has ranged from approximately 600,000 to 1 million portfolios, ending in the final with over 600,000 portfolios at the end of June. Growth could also be seen in accounts other than wallets (token, program and voice accounts). By the end of Q2 2022, Solana had over 1.1 million active accounts daily.

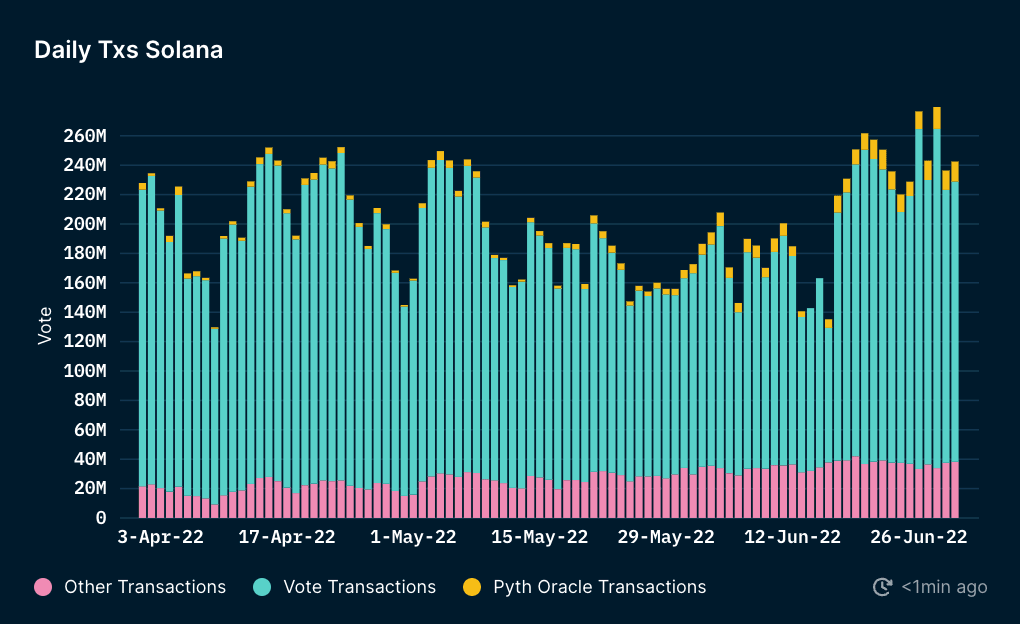

Daily Transactions

Source: Tytanid

The data shown in the chart above shows the daily trades in Solana. It is worth noting here that the largest operations were assigned to voting transactions, which ranged from approximately 100 million to 200 million transactions during one day. It is easy to see that the Other Transactions category showed a downward trend at the beginning of the quarter, which then reversed and started to increase from mid-April to the end of Q2 2022.

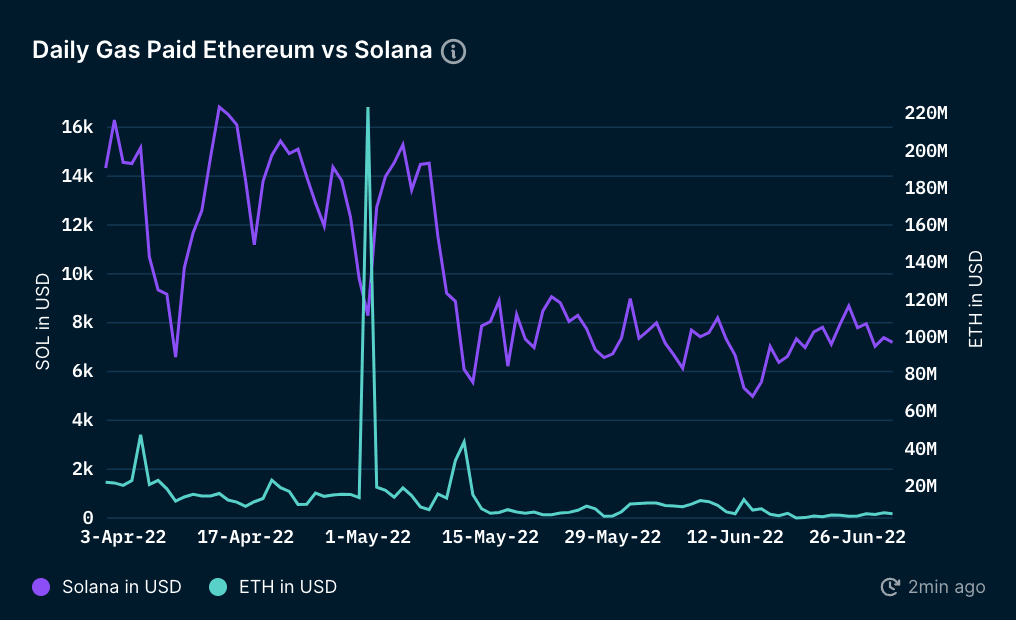

Daily Gas Paid

Source: Tytanid

Analyzing the collective data from today's perspective, we can clearly state that throughout the second quarter of 2022, users paid less for gas on Solana's networks compared to Ethereum. Daily gas paid on Solana was relatively unstable from the beginning of the quarter to mid-May before finally stabilizing in the 5,000-9,000,000 range. In turn, on the Ethereum blockchain, the amount of gas paid per day was relatively stable and oscillated below USD 20 million, except for periods such as the beginning of April, May 1 and mid-May. According to Tytanid experts, the increase in gas fees at the beginning of April was mainly related to the sale of NFT on the OpenSea secondary market. An interesting piece of news for all NFT enthusiasts is that on May 1, 2022, gas charges rose to over $ 220 million when Otherdeed by Otherside NFT was released. During the catastrophic depegging UST event in mid-May there was another increase in transactions. Most of these operations were tied to Ethereum users who traded stablecoins like USDT and USDC.

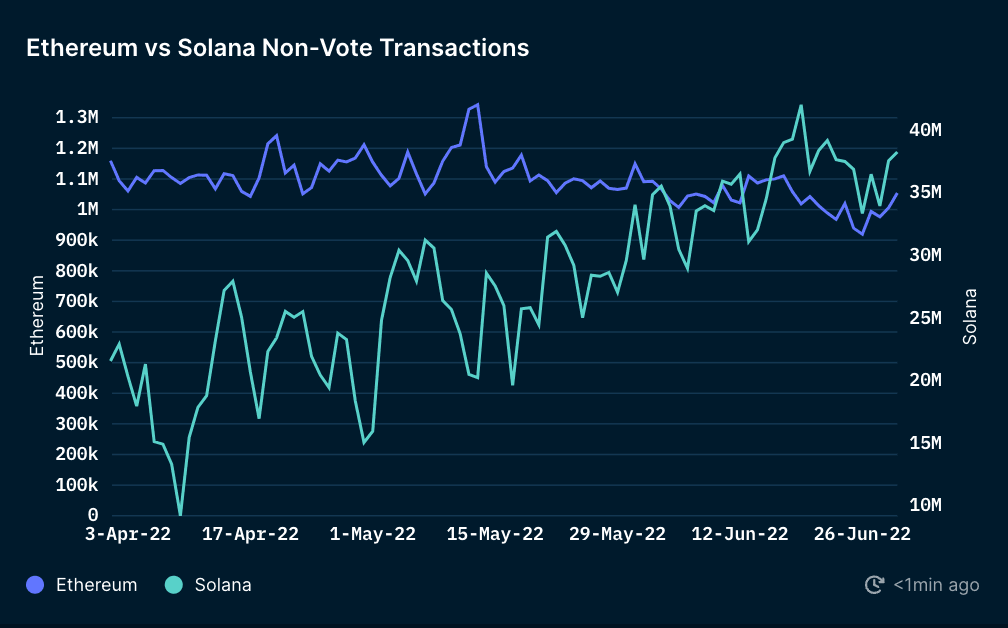

Daily Transaction vs Ethereum

Source: Tytanid

Solana had a much larger daily transaction volume compared to the Ethereum network. A clear upward trend can be observed on Solana's daily non-vote transactions during the second quarter of 2022, although it is worth noting that this is not a constant trend. The data analysis shows that at the end of the second quarter of 2022, there were over 40 million non-vote transactions on the Solana blockchain. In contrast, the daily Ethereum trading volume was rather stable throughout the quarter, hovering around 1 million transactions.

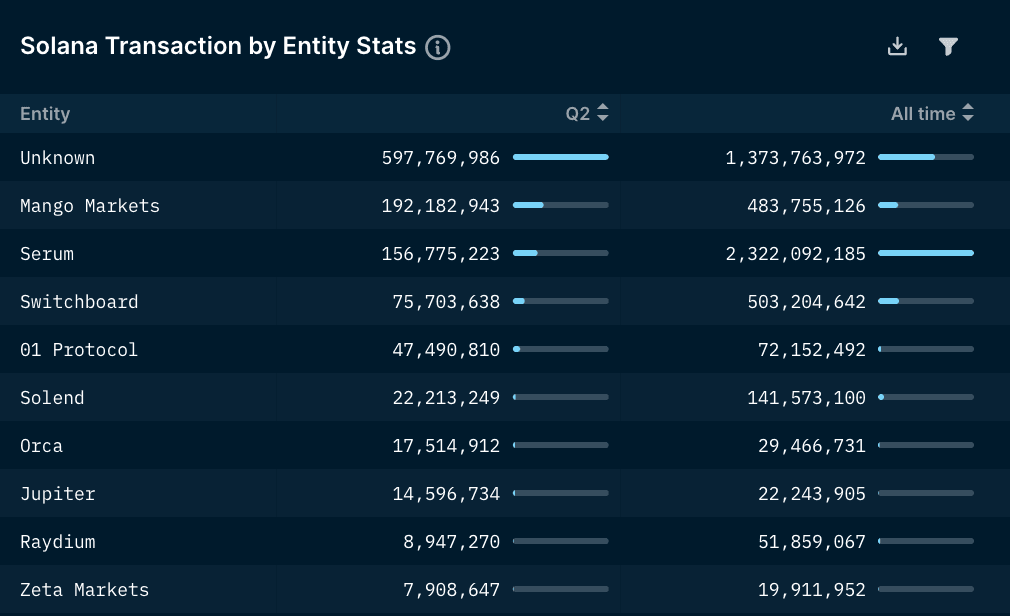

Top Solana dApps by Transactions

Source: Tytanid

The table presented above illustrates the best entities in Solana based on the criterion of the number of transactions during the second quarter of 2022. The most interesting projects include the following entities:

- Switchboard: decentralized oracle network based on Solana blockchain

- Mango Markets: A decentralized exchange where users can trade spot, margin and perpetual futures markets

- Serum: Another popular decentralized exchange with a wide range of trading options

01 Protocol, is a project that offers derivatives trading. It is worth noting that this protocol is a relatively new entity in Solana, but it grew significantly during Q2 2022, recording almost 50 million transactions.

Summary

Throughout the second quarter of 2022, despite numerous inconveniences resulting from both macroeconomic conditions and network downtime, the team behind Solana continued their efforts to improve the network and develop the ecosystem. The best evidence to support the above thesis is the decision to create a Korean grant and investment fund, as well as focusing on building QUIC and the new fee prioritization mechanism. A number of events that are already visible on the horizon bode well for new projects that will certainly appear in the Solana ecosystem. Ambitious plans and consistency in achieving the milestones have led to the development of a significant community that supports Solana in building the blockchain of the future.