Tytanid’s Fantom Quarterly Report - Q2 2022

The report below sheds light on the Fantom ecosystem as well as on chain performance using on-chain parameters.

Abstract

Fantom is a platform built in blockchain technology that is fully EVM compliant. This product was designed using a unique consensus mechanism called Lachesis. Due to Lachesis ’asynchronous and Byzantine Fault-Tolerant nature, the applications within Fantom have fast finality, high-throughput, and bank-grade security.

The Fantom architecture, thanks to the combination of low fees, fast transactions and ease of development, achieved a spectacular adoption jump in September 2021. During the current quarter, obstacles related mainly to the conditions in the broadly understood digital currency market resulted in a progressive decline in the activity of Fantom users. The wave of growth of enthusiasts of this project was lowered in particular by the saga that began with the loud collapse of UST-LUNA, and was additionally supported by the interest rate hike by the Federal Reserve. Nevertheless, in the face of adversity, Fantom did not stop, and the team behind this project successfully made significant network improvements as well as various application integrations.

Phantom Ecosystem

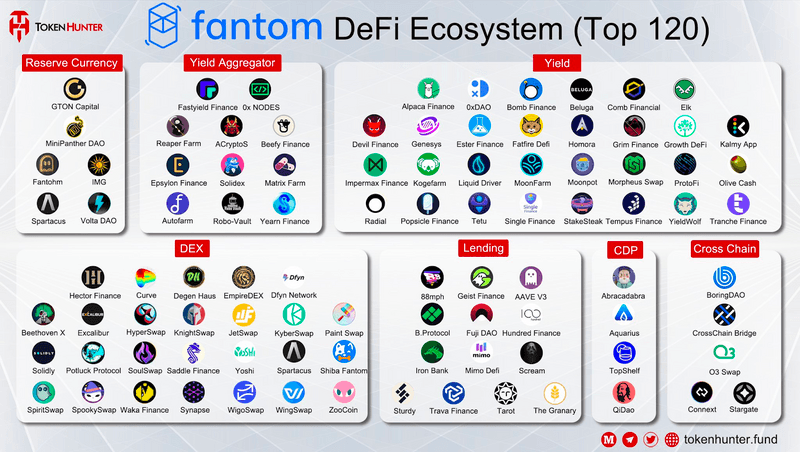

The compatibility of the Fantom system with EVM supports numerous engineers in the efficient and organized transfer of existing dApps that were built on Ethereum to the main Fantom Opera network, which significantly enhances the efficiency of decentralized applications and reduces costs. During the entire second quarter of 2022, Fantom still had a thriving ecosystem of applications integrated with it, in particular Automated Market Maker SpookySwap, Balancer fork Beethoven X, and even games such as Andre Cronje's Rarity, which at this stage invariably attract players each day, which led to approximately 95,000 transactions in the second quarter.

Source: TokenHunter

Key events in the development of Fantom: Q2

SnapSync Rollout

- SnapSync was launched in mid-May. This update enables new nodes to join the network faster and more efficiently. In testnet, the synchronization time can be reduced from 24 hours to even 7 hours.

- SnapSync is built on the "Lachesis Light Repeater" (LLR), a variation on the Lachesis Fantom consensus engine. The mechanism of LLR operation comes down to storing the minimum necessary data from the chain to then enable light stateless synchronization.

- The introduction of this update, along with additional improvements to the entire protocol, has led to a significant drop in gas prices.

- The implementation of SnapSync significantly contributed to the improvement of Fantom decentralization, enabling nodes to generate and verify Genesis files.

fWallet V2 Release

- Fantom launched V2 of its native wallet, fWallet, in late April. This update significantly contributed to the improvement of several critical vulnerabilities.

- Recent changes include modernized UI, ability to view and manage Fantom ecosystem tokens, in-wallet swap, simplified on-chain governance voting, bridge, and redesigned staking interface.

- Fantom will also provide new advanced functions, which include the NFT browser.

Integrations with Fantom

- The constantly increasing number of new wallets that integrate with Fantom is clearly visible. The most famous of these events include interactions with Zerion, Trust Wallet and Crypto.com DeFi Wallet.

- Unmarshal, a unique Blockchain data indexing protocol, has recently been integrated with Fantom.

- The Node-as-a-Service provider, in this case Apex successfully led to the creation of the first fully secured bridge from Avalanche to Fantom.

- Decentralized financial protocols such as 1inch and WooFi can finally be used on the Phantom.

Tytanid data

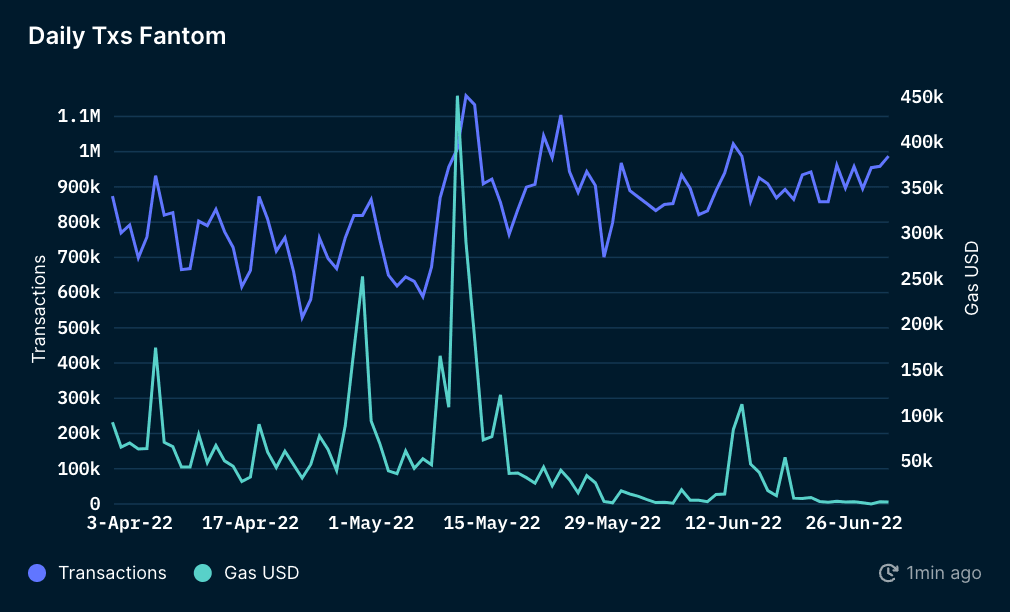

Daily transactions

Source: Tytanid

In the chart presented above, the transaction volume ranged from 500,000 to approximately 1.1 million per day. These numbers showed a slight decline until early May, and then increased significantly in the middle of the same month, following the UST events and, above all, the cataphtrophic collapse of LUNA. During June, the scale of daily transactions was already stabilized.

Going further, the amount of gas paid has decreased noticeably after the introduction of SnapSync, as well as the mid-May protocol improvements, except for a lower increase in mid-June. The non-abnormal gas charges on Fantom are currently less than $ 0.30 for smart contracts and less than $ 0.10 for token transfers between wallets. This leads to the obvious conclusion that with the fast Time to Finality (TTF), Fantom can do well as a popular DeFi hub for investors and traders.

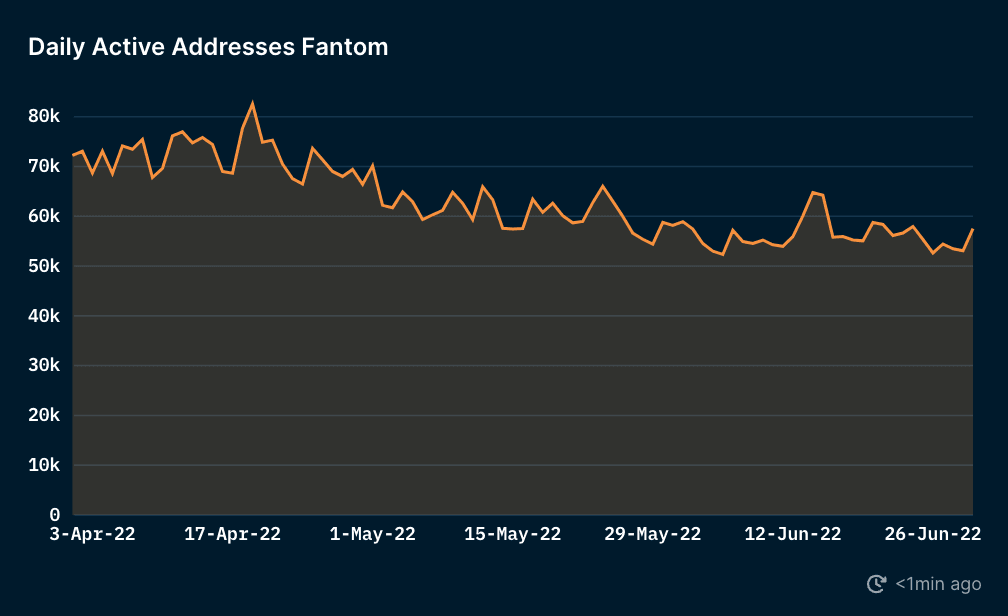

Source: Tytanid

Analyzing the next data presented in the chart above, which comes from the second quarter of 2022, it is clear that from the end of April there was a downward trend in addresses actively using Fantom. This drop was quite significant, as it came from the volume at the initial level of 60-80 thousand to only 50-65 thousand. In the opinion of Tytanid analysts, this should be explained mainly by the slowdown in the digital currency market, which has been taking place since May.

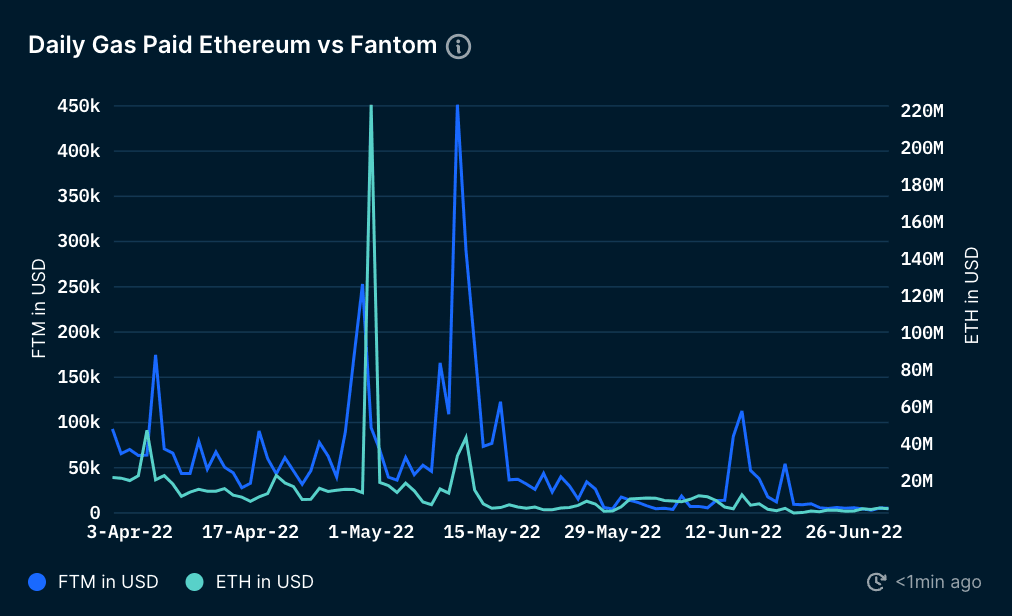

Daily Gas Paid vs Ethereum

Source: Tytanid

In the second quarter of 2022, the gas paid at Fantom was, without surprise, significantly lower than for the Ethereum network. The situation became even clearer, especially after the protocol amendments that took place in mid-May. It is worth noting here that the surge in gas fees in the Fantom network took place on May 11 this year and amounted to USD 450,000, which cryptocurrency market experts linked with operations with the MEV bot. A significantly higher increase in Ethereum gas fees took place on May 1, 2022, when it rose to as much as $ 220 million, fueled by Otherdeed sales for the NFT Otherside transaction.

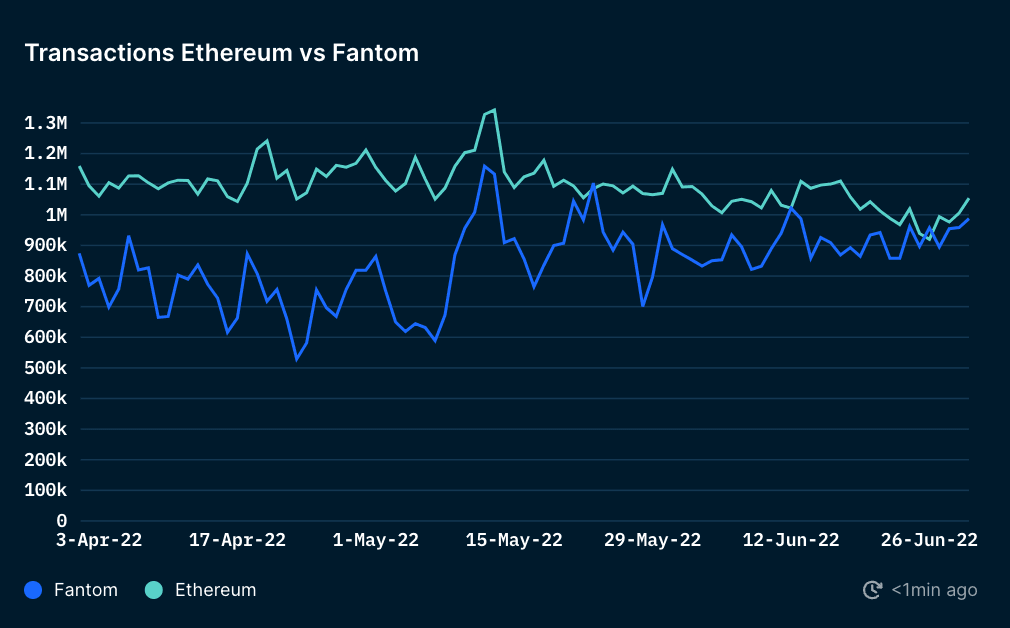

Daily transactions and Ethereum

Source: Tytanid

The number of transactions processed on the Ethereum blockchain exceeded that of the Fantom network and it continued throughout the second quarter of 2022, except at the end of this period, when the number of transactions was similar in both networks. There were 2 days Fantom had slightly more trades, namely May 23, 2022 and June 26, 2022. On both of these days, we found that the spike in activity was attributed to the arbitrage deals of MEV bots and WSPP airdrops.

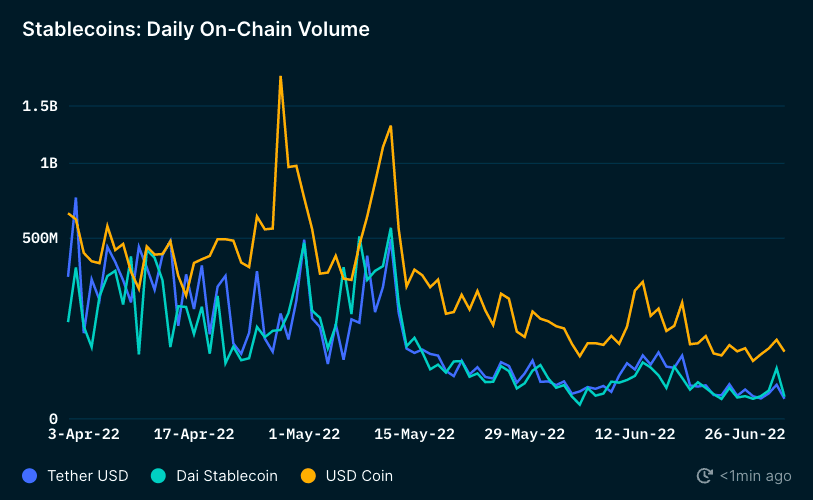

Stablecoins: transaction volume

Source: Tytanid

The chart above indexes the daily traction volume in the chain for USDT, DAI and USDC on the Fantom network. Cumulative daily unit USDC transactions exceeded $ 1 billion in late April and mid-May, and then fell in late June. It is symptomatic that USDT and DAI showed a very similar trend throughout the quarter. While there was not much difference in volume at the start of the aforementioned time frame, the difference between USDC and the other two stablecoins from mid-May showed that Fantom users preferred to trade with USDC.

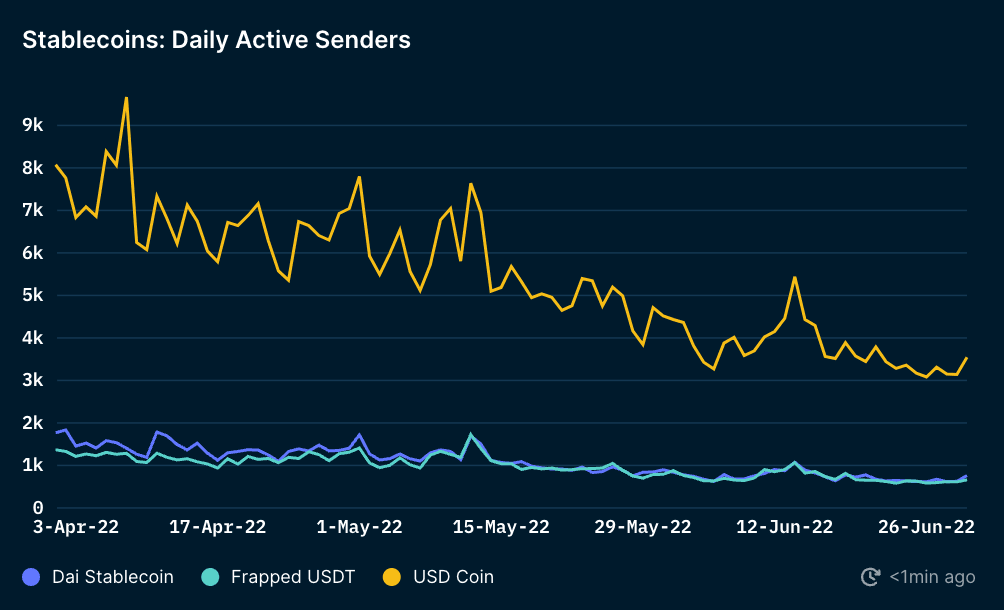

Stablecoins: Daily Active Senders

Source: Tytanid

The chart above shows that the engagement of the daily senders decreased as the quarter progressed. It is noteworthy that DAI and USDT also showed similar, though less significant, patterns. USDT had the fewest daily active senders engaged compared to USDC and DAI. According to the data presented, USDC had the most active participants this quarter, which confirmed that it is the most preferred stablecoin on the Fantom network.

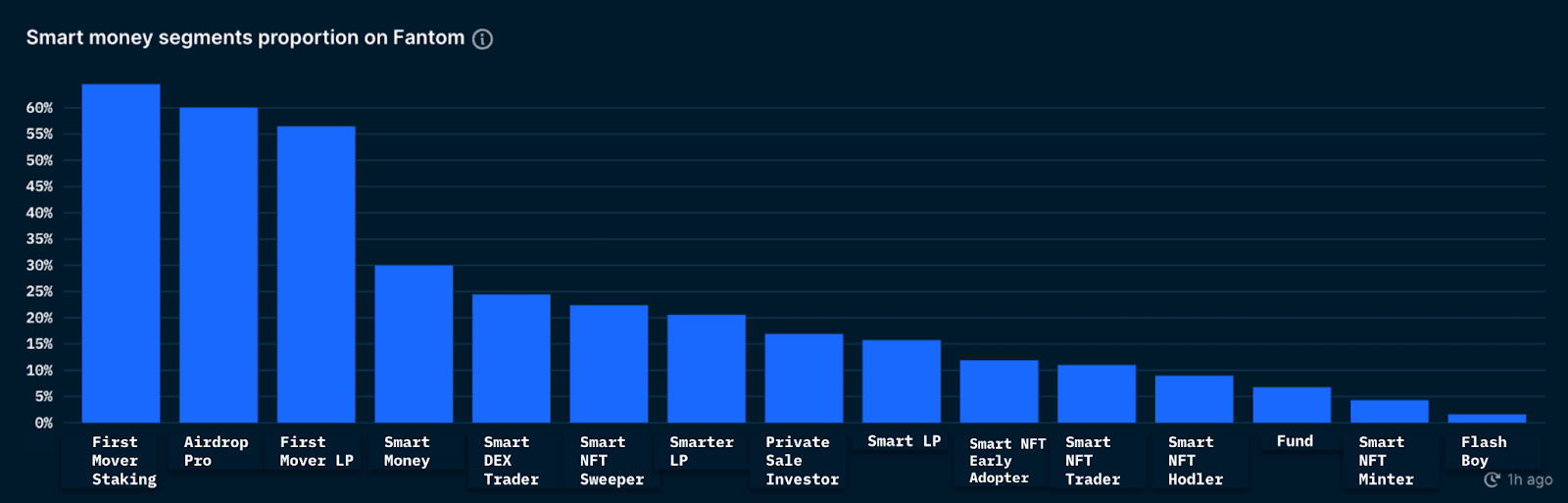

Ethereum Smart Money on Fantom

Source: Tytanid

The chart above shows the division of Smart Money addresses that are active in the Fantom network. They have been categorized based on the type of Smart Money. The illustrated proportions have not changed significantly since the last quarter. This is due to the fact that the types of Smart Money that are attractive in the Fantom network remained similar and we are specifically talking about First Mover Stakers and First Mover LP, which are the fastest addresses in the staking and liquidity pools. No one should be surprised here, as this is simply due to the fact that the most popular Fantom products were the DeFi protocols.

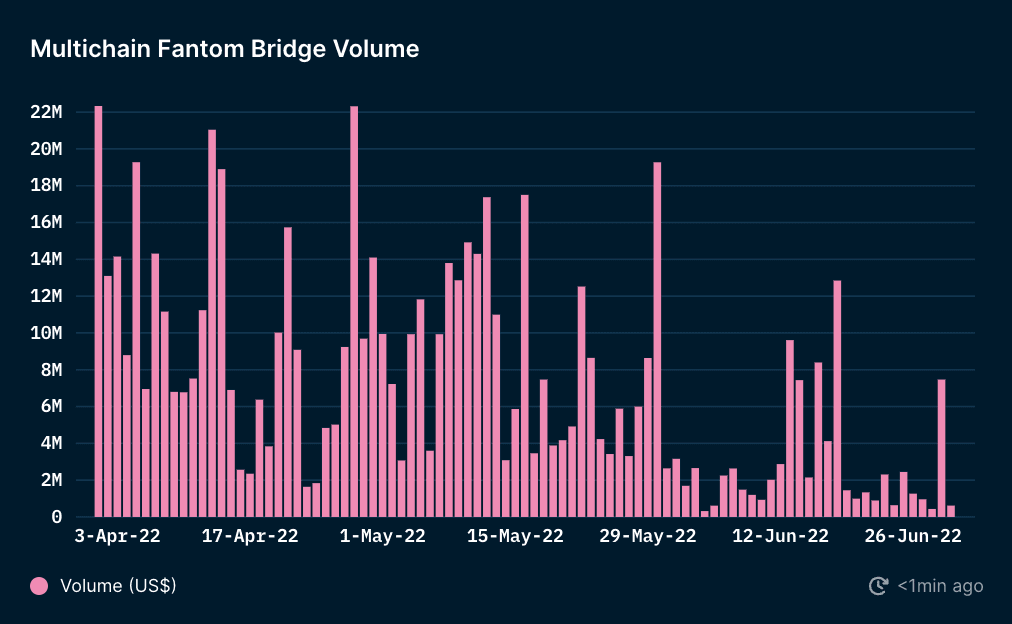

Fantom multi-chain bridge

Source: Tytanid

The graph above shows the daily volume of the Fantom Multichain Bridge. It's easy to see that the volume was relatively volatile in Q2 2022 showing several highs above $ 18 million. Volume appeared to decline throughout June with the highest peak it recorded hovering at just over $ 10 million.

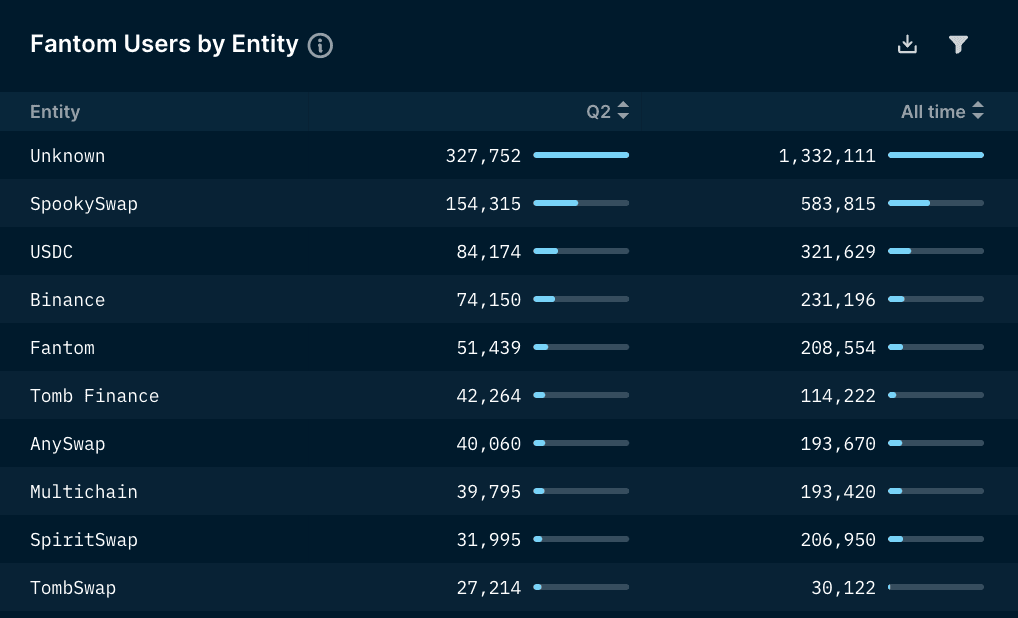

Top Users by Entity

Source: Tytanid

As the above study shows, the entity that was most attractive to users during the second quarter of 2022 was SpookySwap, which is by far the most popular AMM on the web. A new discovery is Tomb Finance and one of its products, TombSwap. Tomb Finance is a protocol by which users are able to provide liquidity for the further development of the Fantom Opera ecosystem.

Summary

Phantom's growth stabilized over the course of the second quarter as there was no protocol to ensure the ultra-growth that Solidly was in the first quarter of 2022. In addition, most likely the general downturn in the digital currency market could have led to a reduction in users' enthusiasm and had a negative impact on the development of Fantom. Nevertheless, it has to be admitted that the efforts of the team behind the Fantom protocol to improve this network this quarter started to pay off with tangible and noticeable results mainly thanks to lower gas fees and faster closing of transactions. These improvements in the next quarter could be a good start for the rapid adaptation of Fantom and for the effective integration of a range of products with this promising protocol.