Tytanid's Ronin Network Quarterly Report - Q2 2022

This report provides an overview of the Ronin Network focusing on chain performance using on-chain parameters.

Abstract

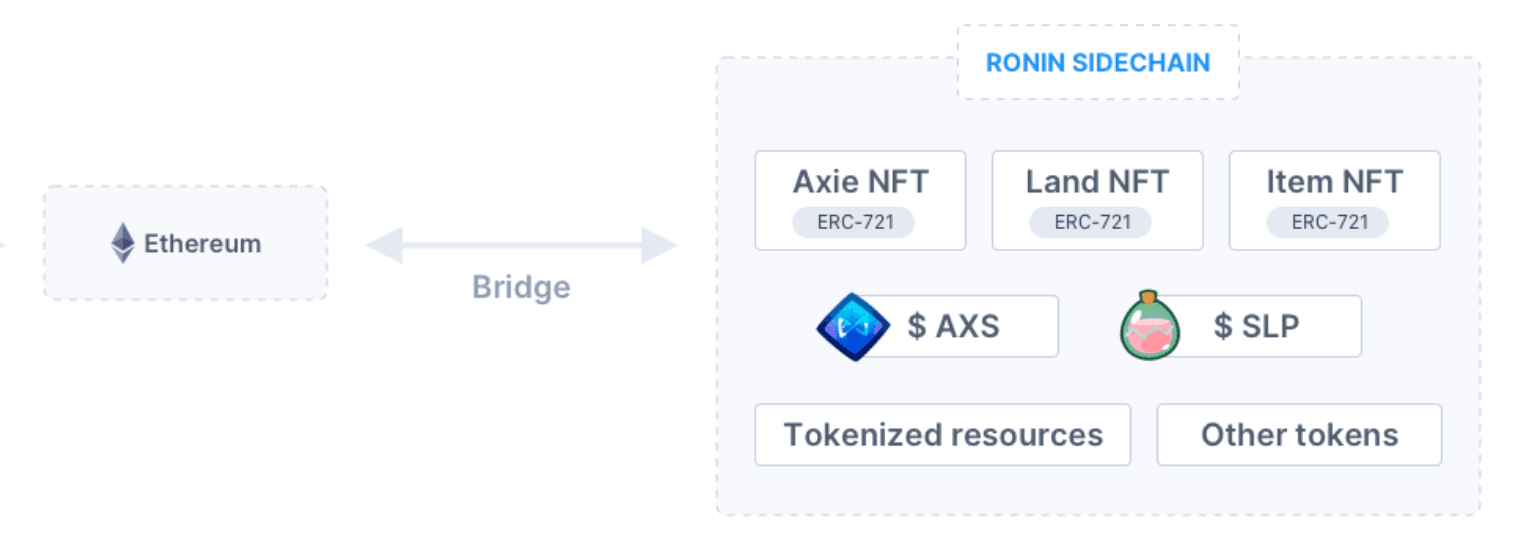

Ronin is an Ethereum sidechain built on purpose for the Axie ecosystem. It was designed and created to lead to the faster development of a new revolution referred to in the blockchain technology space as “play-to-earn”. As a result of these works, Ronin became the most important player in the space of cryptographic games. As of today, the network of this popular protocol powers the entire Axie Infinity ecosystem, which leads to a significant facilitation of transactions and safe storage of own assets, which include - Axies, Land, SLP, AXS, Wrapped ETH (wETH).

On April 7, Axie Infinity launched its newest and long-awaited product called Origin, which is to become the main production version in the near future. The update introduced a wide range of new features , including solutions such as the free Starter Axies, Arena Mode, Crafting, Runes and Charms. It is worth emphasizing that the developers behind this project have not forgotten about their existing users, because all Axie Classic owners can still fully use their NFT axes in Origin.

This year, there was another very important event related to the Ronin community, because with the reopening of the Ronin Bridge, all users of this network whose cryptocurrencies had been previously stolen received a full refund of their lost funds. In April 2022, the largest cryptocurrency exchange in the world, Binance, conducted a funding round worth approximately $ 150 million to help Sky Mavis restore funds on the Ronin Bridge.

What are Ronin Ethereum Sidechains?

Technically, sidechain is a completely separate blockchain that runs parallel to the Ethereum network but functions independently. This solution has its own consensus algorithm and is connected to Mainnet by a bidirectional bridge.

The mechanism of how side chains work is that they support general calculations and are fully compatible with EVM, however they are less decentralized and use a dedicated separate consensus mechanism. In practice, this implies that the sidechain validator quorum could theoretically be fraudulent, but the Ronin Network engineers argue that they prevented this from happening because the side chains are independent. This means that if they were hacked or compromised, then the false data will only be contained in the given chain and will not have any effect on the main chain.

Ronin ecosystem analysis

The Ronin infrastructure is designed to become a game-specific layer (L1), and to offer a broad spectrum of possibilities for introducing game studies, as well as focusing on the collective gaming community. Dedicated side chains have many benefits, but in the opinion of Tytanid experts, one of the main advantages of building this type of system architecture are its almost instant transactions and low fees charged in interactions with Ethereum, which in turn enables millions of microtransactions during the game.

Source: Axie Infinity Whitepaper

Axie Infinity significantly increased in popularity during the previous year, although it must not be forgotten that the total number of transactions decreased then. Moreover, since then the NFT token sales volume has not been impressive and was far from ATH. While the overall number of transactions in the areas identified above is far from the peak, Axie Infinity has unveiled an ambitious roadmap. Those responsible for the development of this project have stated that with the launch and entry into force of Origin, the gameplay will include features such as NFT land plots, free “starter Axies” for onboarding purposes, and many other incentives to overcome today's V2 limitations.

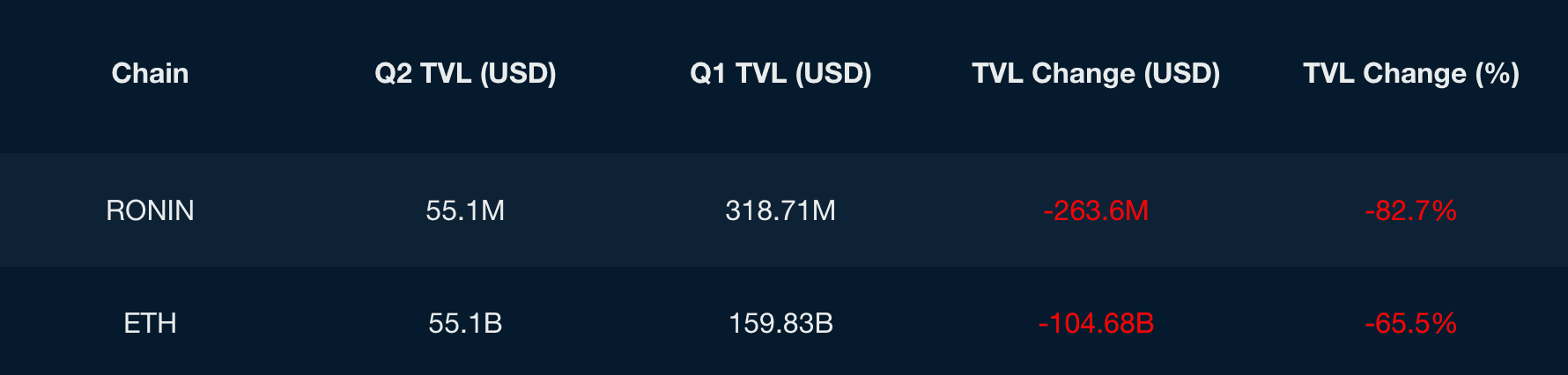

Ronin Total Value Locked

Source: DefiLlama

The data compiled in the table above clearly shows that Ronin's TVL decreased significantly during the previous quarter. However, Tytanid experts advise not to lose sight of the fact that this is mainly due to the general downward trend that is currently taking place on the cryptocurrency market. Nevertheless, it is also worth bearing in mind that the drop rate of TVL was much higher for Ronin (82.7%) than for Ethereum which fell by 65.5%. This was obviously due to the decline in the activity and popularity of Ronin and Axie Infinity this quarter, as well as the widely reported Ronin Bridge breach last quarter.

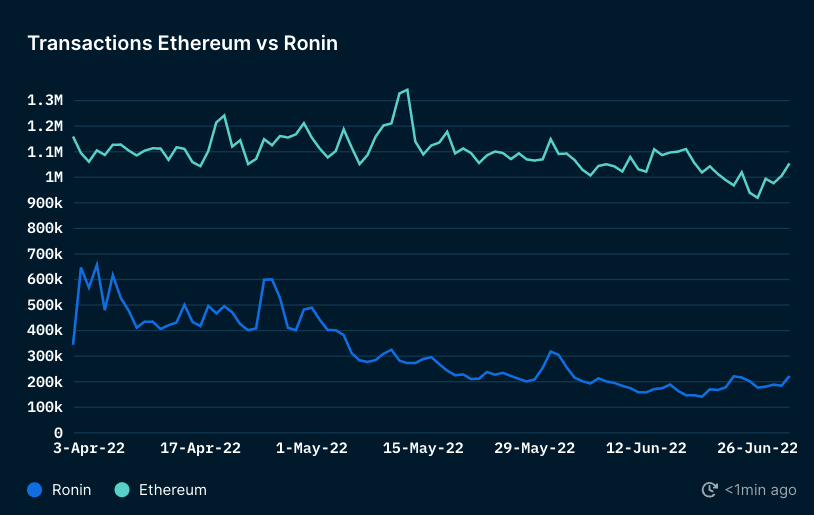

Source: Tytanid

The presented data clearly shows that the number of daily Ronin transactions was roughly half that of Ethereum.

The common element is that each of these networks has experienced a gradual decline. This is because the entire digital currency sector was under strong bearish pressure in the second quarter of 2022. The sudden but short-lived increase in transaction volume at the beginning of the quarter is commonly attributed to Axie Infinity and in this case, of course, the Origin release.

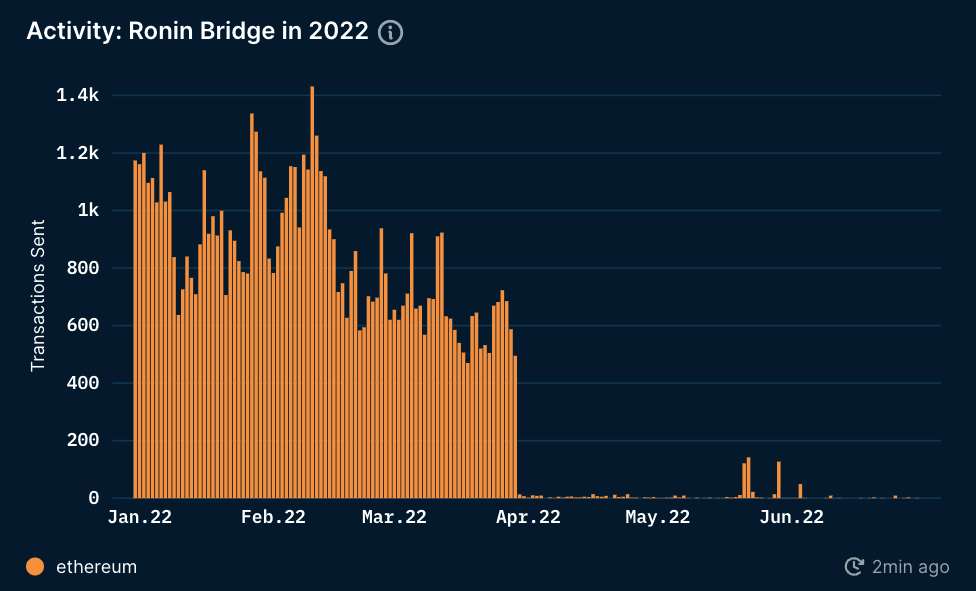

Ronin Bridge Statistics

In the second half of March (day 23 to be exact) the Ronin bridge was in operation, with a loss of approximately 173,600 ETH (at current Ethereum prices, we are talking here of approximately 590 million dollars), as well as an additional 25.5 million USDC. Publicly available sources indicate that approximately 5 out of 9 validators were attacked in connection with this incident. Due to this fact, the bridge was closed and for most of the second quarter of 2022 it lost much of its popularity, which resulted in a significant decrease in activity.

As a consequence of these events, the priority goal for Ronin this quarter was to have 21 independent validator nodes, thus leading to comprehensive network security. Among the organizations added to the validator node pool were Delphi, Dialectic, Animoca Brands, Stable node, and Nansen. However, these efforts were only partially successful, as only 14 validator nodes were found at the end of the second quarter.

Ronin's team managed to successfully reestablish the bridge on June 28 this year. It is worth emphasizing here that after resuming work, the bridge has been enhanced with improved functions. The Ronin team added a software called Bridge Smart Contract that allows reviewers to set daily Ronin Bridge payout limits. The community focused around this project has been assured that all user funds are fully supported by the new bridge in a 1: 1 ratio, with innovative solutions that increase system security.

Source: Tytanid

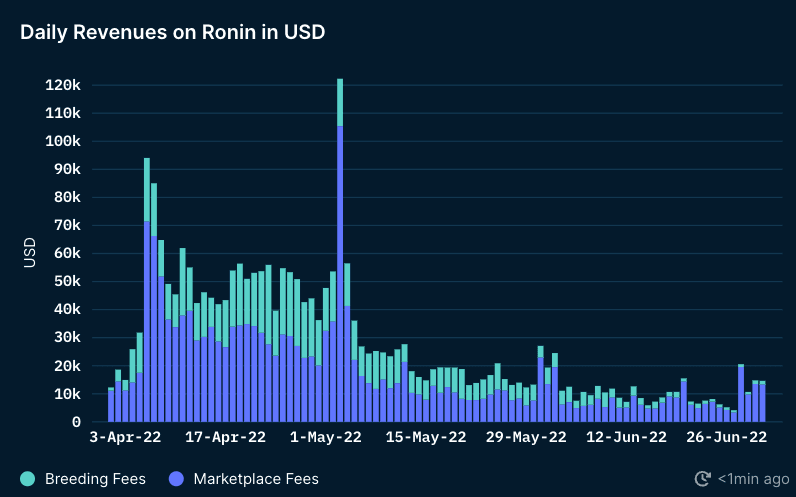

Revenues on Ronin

Source: Tytanid

At the beginning of the second quarter of this year, the Origin mentioned earlier in our report was released, which triggered an avalanche of daily revenues. However, this effect was not long-term and the statistics that appeared right after the launch of this solution were not maintained in the long term. Since then, the daily Ronin revenue (in USD) has gradually declined as the initial positive excitement about the new publication began to wane.

Over time, however, this trend has changed as, after May 3, there was a sudden increase in market charges of approximately $ 105,000. According to Tytanid experts, it should be assumed that it was due to the addition of Land Staking in Axie Infinity. This feature opens the way for users to bet on their virtual plots in exchange for rewards in the form of AXS crypto tokens.

Katana DEX

Katana is a decentralized cryptocurrency exchange built on Ronin's infrastructure. At present, Katana offers the following ETH, AXS, SLP, USDC and RON tokens.

The most important benefits of using Katana are:

- Breeders are free to trade AXS

- Users can exchange SLP to wETH to purchase additional Axie teams with minimal fees

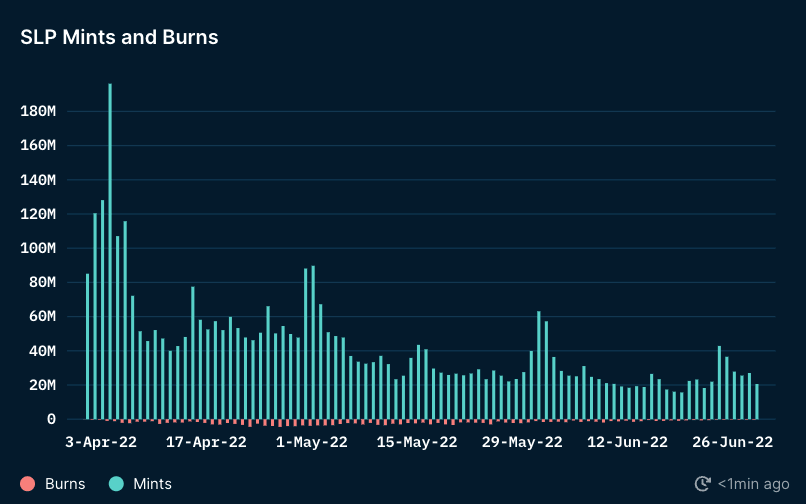

SLP is a native utility token in the Axie ecosystem that is used to breed Axie. The whole architecture has been designed so that when the SLP token is minted more than its burn rate, it reduces the SLP value due to its oversupply on the market.

Source: Tytanid

Development

Axie, based on its own whitepaper, announced several key milestones that they intend to achieve over the next quarter. They are as follows:

- Gameplay on land

- Origin is expected to reach 800,000 downloads,

- Axiecon - Axie Infinity Convention

- Lunacia SDK Alpha: Lunacia SDK Alpha will be put into use by developers to create games using existing Axie Infinity resources and host them on land

Start of the $ AXS ecosystem: Mainstream release of Axie Infinity on IOS / Android, Play-to-earn.

Summary

Summarizing the data from the report, despite the general decline in activity, there have been some significant improvements in the Ronin side chain as well as in the Axie ecosystem. It is also worth noting that the release of Origin itself had a wide impact in the world of cryptocurrencies.

Updating the entire game greatly helped refresh both Axie Infinity and Ronin. The intensive work of the development team has opened up new opportunities for players to enjoy the game again. Land Staking and the re-opening of the Ronin Bridge improved the image of the entire project. Thanks to the newly updated Ronin Bridge architecture, which is available from June 28, 2022, users can transfer funds again between the Ethereum and Ronin blockchain. The bridge has also been significantly improved largely thanks to increased security and restored user funds thanks to the help provided by Binance.