Ethereum and Bitcoin in the hands of whales

An analysis of the volume of Ethereum and Bitcoin futures has shown that both cryptocurrencies have already recovered against the spot volume. In spot markets, traders are able to both buy and sell tokens for immediate delivery. Interestingly, experienced investors at this stage still prefer trading with futures. According to experts, everything indicates that the collapse of the Terra network is behind the entire crypto sector, and the virtual currency market is back on the right path.

Ethereum and Bitcoin futures traders are back in the game

It's no secret that seasoned traders prefer to trade futures because profits can be made in any direction of the market. Traders who are highly skilled and competent benefit from leverage and are generally better capitalised than retail spot traders, so under standard conditions, the futures markets tend to trade higher financial volumes than spot markets.

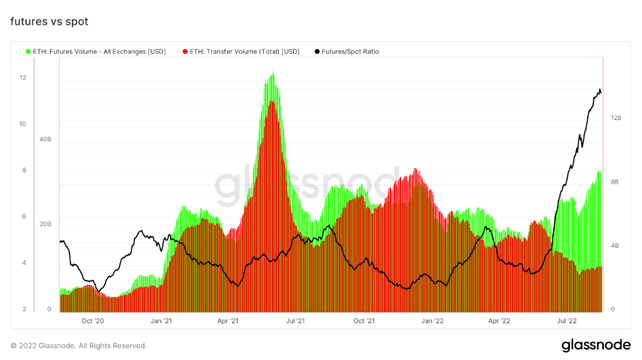

The Ethereum performance chart below shows the overall trend of spot volume lagging behind the futures market. However, it is clearly visible that the spot markets were particularly popular at the end of 2021.

Systematically, from the end of June 2022, the discrepancy between futures contracts and the spot market is becoming more and more visible. Analysts argue that this is due to mounting speculation about joining, in which the existing Ethereum execution layer will be integrated into the Proof-of-Stake (PoS) consensus layer.

Ethereum spot and futures volume (source: Glassnode)

Bitcoin spot and futures markets

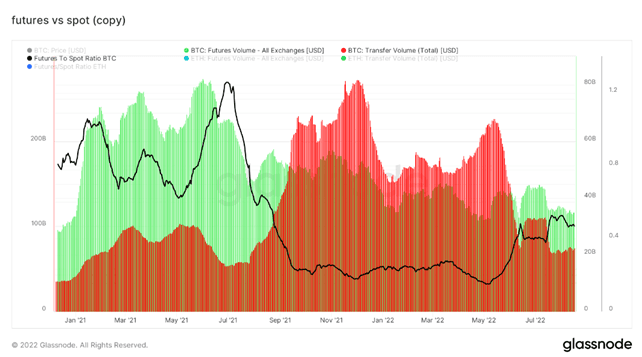

The case of Bitcoin seems to be special in relation to the rest of the market. Different conclusions can be drawn from the analysis of Bitcoin's spot markets and futures. The chart below clearly shows that the volume of futures contracts had a significant advantage in the boom period in 2021. However, the Bitcoin price reached its ATH in the fourth quarter of 2021, which apparently caused this trend to reverse, and the spot volume gained the advantage.

Futures to spot BTC ratio (source: Glassnode)

Nevertheless, from June 2022, futures traders strengthened their position again, which led to an increase in the volume of futures contracts in relation to the volume of spot.