The mechanism of cryptocurrency binary options

Cryptocurrency binary options contracts are a type of derivative that allows an investor to trade with a future yes/no outcome. This can be presented as follows:

BTC will surpass $27,000 on March 18, 2023 at 11:00 UTC+1.

For obvious reasons, this statement must be true or false (except where the price of the underlying asset is perfectly equal to the strike price at market maturity). In the above case, if the investor believes it to be true then he should choose "long" options, while false should lead the investor towards "short" options. Tytanid offers parimutuel cryptocurrency binary options contracts. This means that traders in the part of the market that was wrong will have to make a payment to the other side of the market that correctly predicted the BTC price at the time of market maturity.

First, let's break this process down into prime factors. Let's assume that the cryptocurrency binary options contract market described above in the form of "BTC is above $27,000" has collected a total of 100 ETH from investors. Next, let's assume that 45% of traders were long and the long side of the market was right. In this case, investors who purchased long options would share the remaining 55% of the short side of the market. In the analyzed example, the total sum of earnings of investors who were right will be 55 ETH. Beneficiaries on the long side will get a commission from the side that was wrong. The profit that investors who have purchased long options will get will be proportional to the percentage they have on their own side of the market. All Tytanid Protocol cryptocurrency binary options markets are denominated in ETH and it is the only digital currency that allows you to trade options.

Floating auctions

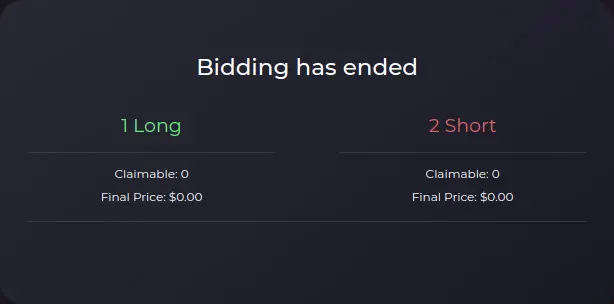

Binary options use a floating auction mechanism. This means that the price of each side is floating, and this state lasts until the end of the bidding phase. In simpler terms, the state of long and short skew at the time of bidding does not in any way affect the value of the potential profit when the market is resolved. Only two factors are relevant in the context of payout. The first is the ratio of the long and short skew at the end of the bidding phase. The second is whether a cryptocurrency binary option is true or false.

When you place an offer and buy an option of your choice, you transfer your ETH to the market's total pool of funds and then choose which side of the market you want to invest in. The smart contract designed by Tytanid developers allows you to take a long and short position simultaneously on any cryptocurrency binary options market. Concluding this issue, in the bidding phase, investors will not be able to fully guess what shape the given cryptocurrency binary options market will ultimately take, because they will only be able to check the current percentage ratio of the long side to the short side. Investors can observe skewness during the bidding phase to build the belief that the current shape of the market reflects the probabilities and the satisfying financial outcome that they associate with the final outcome.

How to create a cryptocurrency binary options market on the Tytanid platform?

In order to create a cryptocurrency binary options market on the Tytanid platform, you need to go to the "Create a Market" website. The first step after doing this is to set the parameters of a given market. Start by selecting the asset class you are interested in. The following classes of underlying instruments are available: cryptocurrencies, fiat currencies, equity and commodities. After selecting the type of asset, select the specific underlying instrument for which you want to create a new market. The next thing you should do is set the strike price (several currencies are available). Next, choose the amount you want to fund the new cryptocurrency binary options market. The minimum amount that can be used to create a market is the equivalent of $50 in ETH. Then go to set the end date and time of the bidding phase. Once you've done that, set a date and time when the market should reach maturity. Once you've completed all the steps above, use the slider to select how you want to allocate your funds. All cryptocurrency binary options contracts on the Tytanid platform offer the opportunity to take both the long and short side of the market simultaneously. The last step is to check the market summary on the right side of the screen. If all the parameters you set are correct, click the "Create a Market" button.

Participation in open markets

The Tytanid protocol allows users to both create new cryptocurrency binary options markets and join markets that have been created by other traders. There are three phases in which a market can exist. These are Bidding, Trading or Maturity. The decisive factor in which side of the market wins is whether the price of the asset on which cryptocurrency binary options have been traded is above or below the strike price when the market reaches maturity. If the value of the asset for which the options have been opened is higher than the strike price, then traders who bought long options outperform investors who bought short options. On the other hand, when the price of the underlying asset for which the market has been opened is lower than the strike price, traders who have bought short options outperform investors who have taken positions on the long side of the market.

Bidding phase

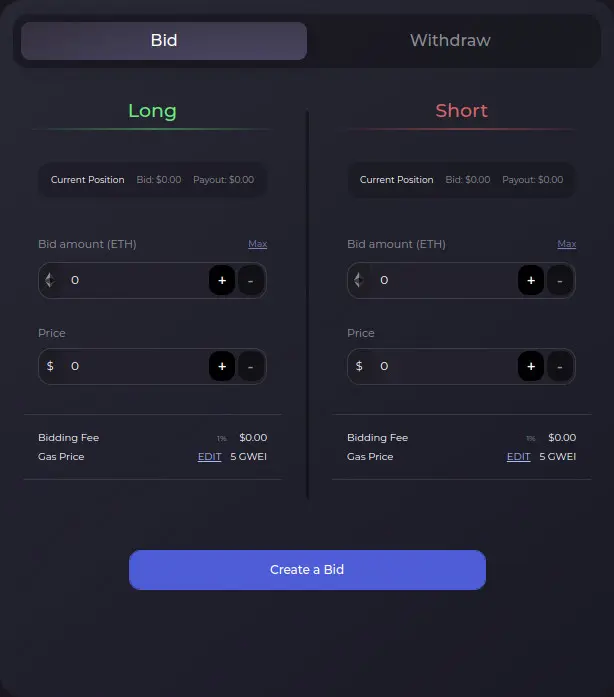

This is the only phase in the history of the market that allows traders to bid long or short options. The Tytanid protocol in the bidding phase offers the possibility to withdraw ETH invested in the market. However, such a withdrawal involves paying a 5% commission on the amount withdrawn from the market by the trader. During the bidding phase, traders can place an unlimited number of bids on any side of the market from the same wallet.

Trading phase

Once the trading phase has started, you can no longer place bids on the respective cryptocurrency binary market. Since then, the parameters of the market are finally formed. In the trading phase, it is also not possible to withdraw the ETH invested by the trader in a given market. The shape of the market will determine the size of the potential profit or loss for traders on both sides of a cryptocurrency binary options contract.

Maturity phase

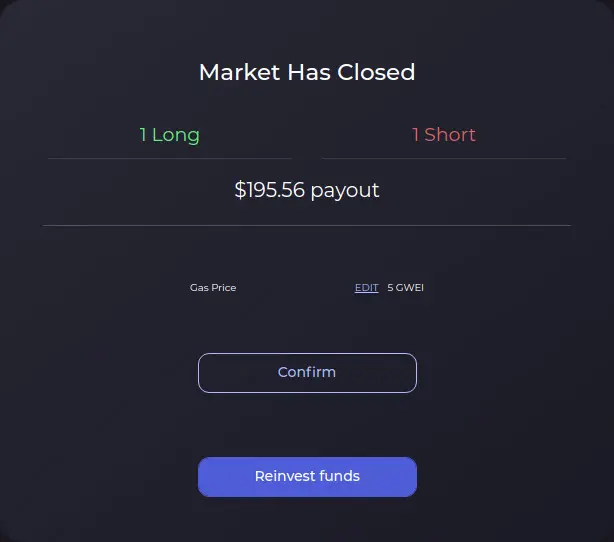

From this point on, cryptocurrency binary options begin to mature. For example, for the market "BTC > $27,000 on March 18, 2023 at 11:00 UTC+1", the maturity date is March 18, 2023 at 11:00 UTC+1. When the market matures, you can take profits in case where you are on the winning side of the market. The maturity phase is limited in time and lasts 6 months. This means that during this period, all options from the winning side of the market must be withdrawn to an external cryptocurrency wallet or reinvested, otherwise they will be lost. Options that do not undergo these steps within 6 months of the start of the maturity phase will become Tytanid Protocol profit.

Closing thoughts

We are currently observing a quantum leap in new functionalities in the field of new technologies in finance. Thanks to the innovative opportunities offered by the distributed ledger, banking and the broadly understood financial industry are experiencing a real boom in development. For the first time in history, the global financial system is fully accessible to every member of the world's population. Anyone at any time can participate in the management of DeFi protocols, as well as sit at the table where the world of decentralized finance is actively being created.

Already at this early stage, the DeFi ecosystem is gradually catching up with the traditional financial sector. Despite some obstacles that come with operating in regulatory uncertainty, the world of decentralized finance is on its way to becoming mainstream. At the moment, DeFi and fintech entrepreneurs are joining together, which brings a turning point where the emerging financial technology of the future will be the cornerstone for building a new financial system.